[vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern”][vc_column][vc_column_text]

Posted By [post_author]

Are we there yet? If you have ever spent time in a car during a family road trip, this is a question heard all too often. This summer it also applies to whether the U.S. economy is in a recession or not. While the answer can be confusing, we have listed out several of the factors at play to help you navigate the coming weeks and months.

Reading the recession signposts.

On July 28, 2022, the Bureau of Economic Analysis estimated the U.S. experienced another quarter of negative economic growth with a second quarter estimate of -0.9% on top of the first quarter result of -1.6%. Historically many have judged two consecutive quarters of Gross Domestic Product (GDP) growth to indicate a recession. But does this mean a US recession has arrived?

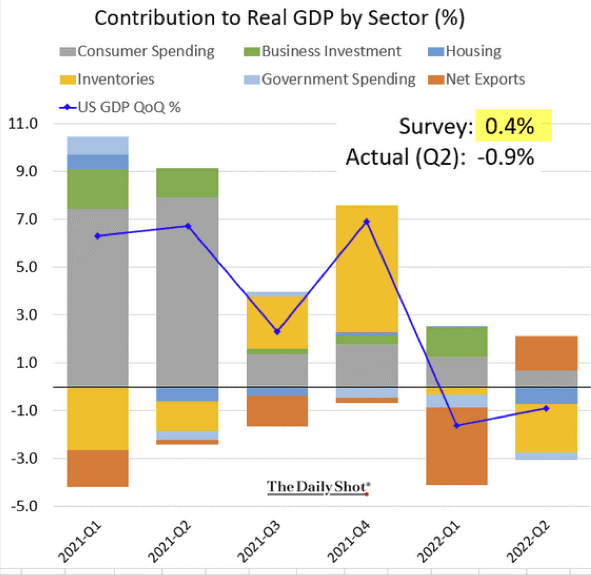

GDP is a measurement of the total market value of all U.S. (domestic) goods and services produced in a given quarter or year. Essentially it is an aggregation of personal consumption (C), private investment (I), government purchases (G) and trade (export – imports (X-M)). The equation is C + I + G + (X-M). Below you can see recent contributions to GDP growth, or lack thereof, over the last 6 quarters.

The largest contributor is personal consumption accounting for 70% of GDP. Viewing the chart above, recent spending (gray bar) has continued to grow but at a much more moderate pace. This critical component was not enough to offset other contributions to GDP which tend to be more volatile from quarter to quarter. For example, inventories (yellow) have been a drag on growth the last 2 quarters, particularly for the most recent Q2 2022 estimate. During the 2nd half of last year companies rushed to restock depleted inventories induced by the pandemic related supply chain issues. A lack of available inventory wreaked havoc with meeting increased demand for goods which may have over corrected to a surplus of supplies.

NBER’s many routes often tell us where we have been.

The volatile GDP components are why others rely on the National Bureau of Economic Research (NBER) to determine when the US economy enters and exits a recession. The NBER defines a recession as “a significant decline in economic activity spread across the economy”—an opaque definition which includes observations of real income, employment, industrial production, and wholesale retail sales. It is kind of like a parent responding to the question, “Are we there yet?” with a “We’ll get there when we get there.”

Using NBER’s methodology, many will point to the strong labor market with record low unemployment rates as evidence the U.S. is not in a recession. However the unemployment rate tends to bottom prior to or during a recession, as seen in the graph below.

Incorporating wider range of economic indicators along with judging the depth and duration of contractions means it takes time for the NBER to “officially” determine recessions. Often their announcements may occur 6-12 months after a recession has begun.

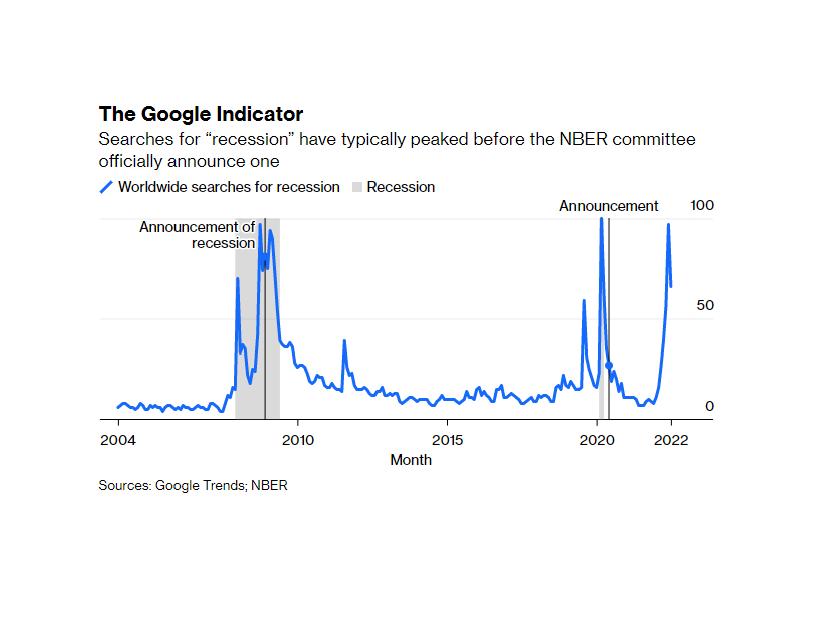

The Google Indicator

Like using Google Maps for directions, individuals have sought out their own road map to recessions. Below Google searches for “recession” have soared this year which have typically preceded economic contractions in the recent past. This indicates there is at least an elevated probability the US is currently, or soon will be, in a recessionary environment.

So, are we there yet?

It is difficult to determine whether we are currently in an official recession. At the very least the economy is experiencing a significant slowdown in growth. To contain inflation the Fed is attempting to tap the brakes of demand without significantly increasing the unemployment rate to avoid an NBER defined recession. Based upon recent employment data there is likely much more tightening in financial conditions on the horizon. Which can have significant impacts on consumer sentiment, corporate profits, and valuations.

If the economy is in fact contracting, we do feel it will be a shallow downturn and a normal part of the economic cycle. However, in our opinion it does call for cautious steering of tactical allocations within portfolios. We are consistently reviewing portfolios to understand the current opportunities versus risks and how they help our clients reach their unique destinations.

What does this mean for my financial goals?

Whether we’re “there” or not, our team is here as your navigator to help you make pragmatic decisions for your peace of mind. Reach out to your adviser or

connect with us if you have questions about your financial plan.

[/vc_column_text][/vc_column][/vc_row]

Recession Roadmap(s): Is the US Economy in a Recession?

[vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern”][vc_column][vc_column_text]

Posted By [post_author]

Reading the recession signposts.

On July 28, 2022, the Bureau of Economic Analysis estimated the U.S. experienced another quarter of negative economic growth with a second quarter estimate of -0.9% on top of the first quarter result of -1.6%. Historically many have judged two consecutive quarters of Gross Domestic Product (GDP) growth to indicate a recession. But does this mean a US recession has arrived?

GDP is a measurement of the total market value of all U.S. (domestic) goods and services produced in a given quarter or year. Essentially it is an aggregation of personal consumption (C), private investment (I), government purchases (G) and trade (export – imports (X-M)). The equation is C + I + G + (X-M). Below you can see recent contributions to GDP growth, or lack thereof, over the last 6 quarters.

The largest contributor is personal consumption accounting for 70% of GDP. Viewing the chart above, recent spending (gray bar) has continued to grow but at a much more moderate pace. This critical component was not enough to offset other contributions to GDP which tend to be more volatile from quarter to quarter. For example, inventories (yellow) have been a drag on growth the last 2 quarters, particularly for the most recent Q2 2022 estimate. During the 2nd half of last year companies rushed to restock depleted inventories induced by the pandemic related supply chain issues. A lack of available inventory wreaked havoc with meeting increased demand for goods which may have over corrected to a surplus of supplies.

NBER’s many routes often tell us where we have been.

The volatile GDP components are why others rely on the National Bureau of Economic Research (NBER) to determine when the US economy enters and exits a recession. The NBER defines a recession as “a significant decline in economic activity spread across the economy”—an opaque definition which includes observations of real income, employment, industrial production, and wholesale retail sales. It is kind of like a parent responding to the question, “Are we there yet?” with a “We’ll get there when we get there.”

Using NBER’s methodology, many will point to the strong labor market with record low unemployment rates as evidence the U.S. is not in a recession. However the unemployment rate tends to bottom prior to or during a recession, as seen in the graph below.

Incorporating wider range of economic indicators along with judging the depth and duration of contractions means it takes time for the NBER to “officially” determine recessions. Often their announcements may occur 6-12 months after a recession has begun.

The Google Indicator

Like using Google Maps for directions, individuals have sought out their own road map to recessions. Below Google searches for “recession” have soared this year which have typically preceded economic contractions in the recent past. This indicates there is at least an elevated probability the US is currently, or soon will be, in a recessionary environment.

So, are we there yet?

It is difficult to determine whether we are currently in an official recession. At the very least the economy is experiencing a significant slowdown in growth. To contain inflation the Fed is attempting to tap the brakes of demand without significantly increasing the unemployment rate to avoid an NBER defined recession. Based upon recent employment data there is likely much more tightening in financial conditions on the horizon. Which can have significant impacts on consumer sentiment, corporate profits, and valuations.

If the economy is in fact contracting, we do feel it will be a shallow downturn and a normal part of the economic cycle. However, in our opinion it does call for cautious steering of tactical allocations within portfolios. We are consistently reviewing portfolios to understand the current opportunities versus risks and how they help our clients reach their unique destinations.

What does this mean for my financial goals?

[/vc_column_text][/vc_column][/vc_row]

Related Posts

Q1 2024 Webinar Review

Despite recent market volatility, the markets are off to a positive start for the year, with the S&P 500 providing its best 1st quarter return since 2019. In our 2024

Q3 2023 Webinar Review

We hope everyone is enjoying the fall season. Below is the link to FAS Wealth Partners’ 3rd quarter of 2023 review featuring a special guest James Meyers, CFA. Mr. Meyers is a